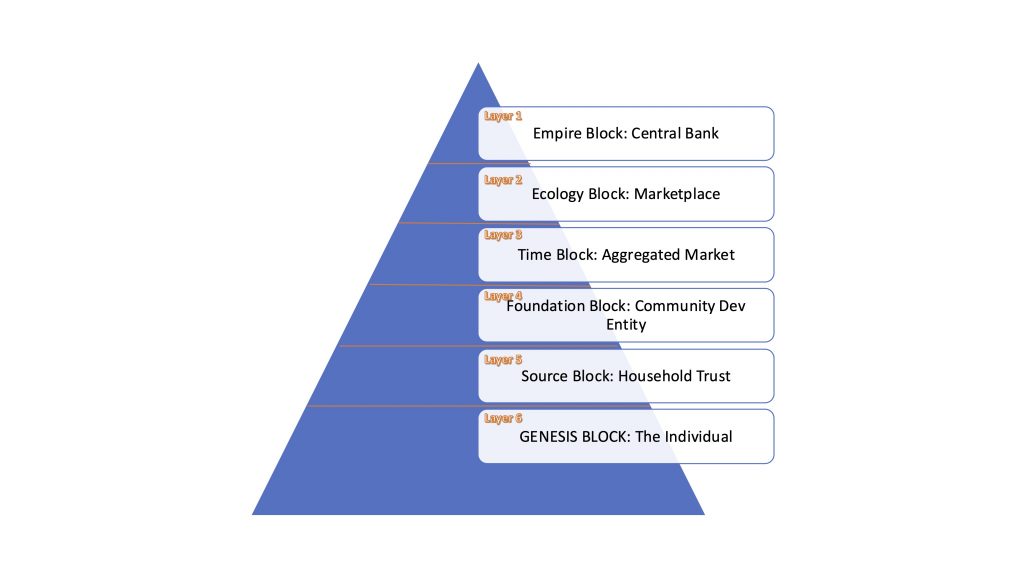

SourceEnergy Blockchain Architecture

Layer 6: GENESIS BLOCK – The Individual

Role: The foundational layer representing individual participants within the SourceEnergy Blockchain.

Function: Individuals can contribute energy, make investments, and participate directly in decentralized finance (DeFi) opportunities.

Significance: As the starting point in the ecosystem, the individual layer emphasizes personal empowerment and grassroots engagement, in alignment with the Wealth Ecology Model’s focus on sustainable wealth generation starting at the individual level.

Layer 5: Source Block – Household Trust

Role: A level dedicated to family or household trusts that manage and preserve intergenerational wealth.

Function: Household trusts at this layer can participate in investments, manage family-owned renewable assets, and pass down sustainable wealth.

Significance: This layer introduces structured, intergenerational involvement in the blockchain ecosystem, allowing families to contribute to and benefit from the aggregated wealth generated through renewable energy investments.

Layer 4: Foundation Block – Community Development Entity (CDE)

Role: Community Development Entities (CDEs) or cooperatives that manage communal investments and projects.

Function: CDEs coordinate community-driven renewable energy projects, fund local initiatives, and distribute profits among community members.

Significance: This layer empowers communities to engage collectively, pooling resources for greater impact. The focus on CDEs aligns with the Wealth Ecology Model’s goal of fostering community-driven economic growth.

Layer 3: Time Block – Aggregated Market

Role: The aggregated marketplace for community and household contributions of renewable energy.

Function: Surplus energy contributions from individuals, households, and communities are aggregated and tokenized for sale in energy markets.

Significance: This layer facilitates large-scale market participation, where aggregated energy assets contribute to the grid, enabling participants to earn income based on their energy production.

Layer 2: Ecology Block – Marketplace

Role: A decentralized marketplace for trading tokenized assets, including renewable energy shares, carbon credits, and other environmentally aligned financial instruments.

Function: Allows participants to buy, sell, and trade assets within the ecosystem, facilitating liquidity and value exchange.

Significance: The marketplace fosters economic activity within the blockchain ecosystem, enhancing liquidity and allowing participants to benefit from the energy assets and sustainability-oriented tokens.

Layer 1: Empire Block – Central Bank

Role: The apex layer, representing the central governance and financial oversight entity for the ecosystem.

Function: Manages the issuance of currency, regulatory compliance, and system-wide policy enforcement within the blockchain framework.

Significance: The central bank layer provides stability and oversight, ensuring that all transactions align with the ecosystem’s goals, adhering to regulatory standards, and safeguarding the economic health of the network.

Overall Structure and Functionality

This framework illustrates a hierarchical yet interdependent model for the SourceEnergy Blockchain, where each layer supports the ecosystem’s values of transparency, sustainability, and ethical wealth generation. The structure allows individual participants to scale their impact up to community and market levels, integrating personal and collective efforts into a cohesive, sustainable energy economy.

Layer-by-Layer Technical Integration and Interaction

Layer 6: GENESIS BLOCK – The Individual

- Technical Components:

- User Wallets: Each individual is assigned a digital wallet on the blockchain to store assets, including tokenized energy contributions and investments.

- Identity Verification: KYC/AML protocols ensure verified, unique participation. Blockchain handles permissions, allowing individuals to access investment, energy tracking, and carbon offsetting tools.

- Smart Contracts: Individuals use smart contracts to invest in renewable energy projects or sell surplus energy.

- Data Flow:

- Data on energy contributions, investments, and usage metrics is recorded on the blockchain. Individual metrics aggregate to higher layers, contributing to larger energy pools.

- Interactions with Other Layers:

- Upward: Individual contributions are aggregated at the Source Block (Layer 5) and the Foundation Block (Layer 4).

- Downward: Individuals receive revenue distributions from the grid market and ecosystem incentives, facilitated by the central bank and marketplace layers.

Layer 5: Source Block – Household Trust

- Technical Components:

- Tokenized Assets: Household trusts can purchase tokenized energy assets, allowing family wealth to be tied directly to sustainable investments.

- Automated Wealth Distribution: Smart contracts automate income distribution and reinvestment options within the household trust.

- Private Ledger: Maintains a ledger for household members to track asset distribution, ensuring transparency among family members.

- Data Flow:

- Household-level investments and contributions flow upward to aggregate with other community entities and, ultimately, the grid market.

- Data on returns and asset values flows back to household members.

- Interactions with Other Layers:

- Upward: Household contributions add to the Community Development Entity’s (CDE) pooled resources in the Foundation Block (Layer 4).

- Downward: Households receive income and asset appreciation from aggregated energy sales at the market levels (Layer 3 and Layer 2).

Layer 4: Foundation Block – Community Development Entity (CDE)

- Technical Components:

- Community Fund Management: CDEs can pool contributions from individuals and households to invest in larger renewable projects.

- Profit Sharing Smart Contracts: Automate distribution of returns based on each member’s contribution to community-owned assets.

- Impact Metrics and Reporting: Blockchain records and reports on social and environmental impact, allowing CDEs to show benefits to their members.

- Data Flow:

- Contribution data flows into aggregated pools that represent the community’s collective energy production and resources.

- Impact data (carbon offset, energy produced, community benefit metrics) is calculated and shared with members.

- Interactions with Other Layers:

- Upward: Aggregated contributions from CDEs are fed into the Time Block (Layer 3) for market-level aggregation.

- Downward: CDEs distribute grid market revenue back to individual members and household trusts.

Layer 3: Time Block – Aggregated Market

- Technical Components:

- Energy Pooling Smart Contracts: Collect energy contributions from CDEs, households, and individuals, creating a single, large energy asset.

- Dynamic Pricing Mechanism: Uses real-time grid data to price energy contributions, determining how much each unit of energy is worth based on market demand.

- Revenue Distribution Protocols: Smart contracts automate distribution of revenue generated from grid market participation to each lower layer based on contribution size.

- Data Flow:

- Aggregated energy data is tracked in real time to reflect energy contributions from the SourceEnergy ecosystem.

- Price data and transaction records are stored immutably on the blockchain for transparent accounting.

- Interactions with Other Layers:

- Upward: Revenue generated is fed into the marketplace (Layer 2) where it is exchanged and distributed.

- Downward: Proceeds from market sales are distributed to CDEs, households, and individuals based on their respective contributions.

Layer 2: Ecology Block – Marketplace

- Technical Components:

- Token Exchange System: Facilitates trading of energy credits, carbon credits, and other tokenized assets within the SourceEnergy ecosystem.

- Automated Market Maker (AMM): Provides liquidity for energy and environmental assets, ensuring participants can buy and sell assets efficiently.

- Compliance and Regulatory Monitoring: Enforces regulations for participants and transactions, ensuring transparency and adherence to market standards.

- Data Flow:

- Transaction records are tracked on the blockchain, allowing for transparency and historical analysis of asset trades.

- Market data, such as demand and pricing, flows downward to inform real-time pricing in the Aggregated Market (Layer 3).

- Interactions with Other Layers:

- Upward: Marketplace transactions impact the currency issuance and policy at the Empire Block (Layer 1).

- Downward: Marketplace prices inform dynamic energy pricing for the Aggregated Market (Layer 3).

Layer 1: Empire Block – Central Bank

- Technical Components:

- Governance and Policy Management: Oversees currency issuance, interest rates, and systemic policies affecting the entire SourceEnergy ecosystem.

- Regulatory Compliance Smart Contracts: Ensure all participants are compliant with local and international financial regulations.

- Reserve Fund: Centralized pool to stabilize the ecosystem and provide liquidity for marketplace participants in case of market fluctuations.

- Data Flow:

- Economic data flows downward, impacting pricing, investment decisions, and participant compensation across the ecosystem.

- Reserve fund usage and policy changes are recorded on the blockchain, with transparency provided to all participants.

- Interactions with Other Layers:

- Downward: Central bank actions affect pricing, liquidity, and stability across all layers, from marketplace transactions to individual contributions.

- Upward: Data from marketplace transactions, aggregated market participation, and community impact flows up to inform central bank policies and currency management.

Overall Flow of Data and Value

- Bottom-Up Data Flow:

- Contributions and investments from individuals, household trusts, and CDEs aggregate upward, creating larger energy assets for the grid.

- Revenue generated from these assets flows back down to each participant type based on contribution, supporting personal, family, and community-level financial goals.

- Top-Down Regulatory Flow:

- Central bank policies and regulations cascade downward, ensuring ecosystem stability, compliance, and alignment with SourceEnergy’s social and environmental goals.

- Circular Marketplace Dynamics:

- The marketplace (Layer 2) acts as a hub, allowing participants to trade tokenized assets, access liquidity, and monetize renewable energy contributions.

- Central bank policies ensure marketplace stability, while real-time pricing drives the aggregated market’s dynamics, creating a feedback loop that informs individual and community-level participation.

Conclusion

This layered blockchain architecture ensures that SourceEnergy’s ecosystem can integrate participants at all levels—individual, family, community, and market—allowing each to contribute to and benefit from renewable energy and sustainable wealth. The top-down governance and bottom-up empowerment combine to create a resilient, inclusive, and self-sustaining economic model that aligns with the Wealth Ecology Model, redefining wealth as an ecosystem that fosters growth, equity, and sustainability.