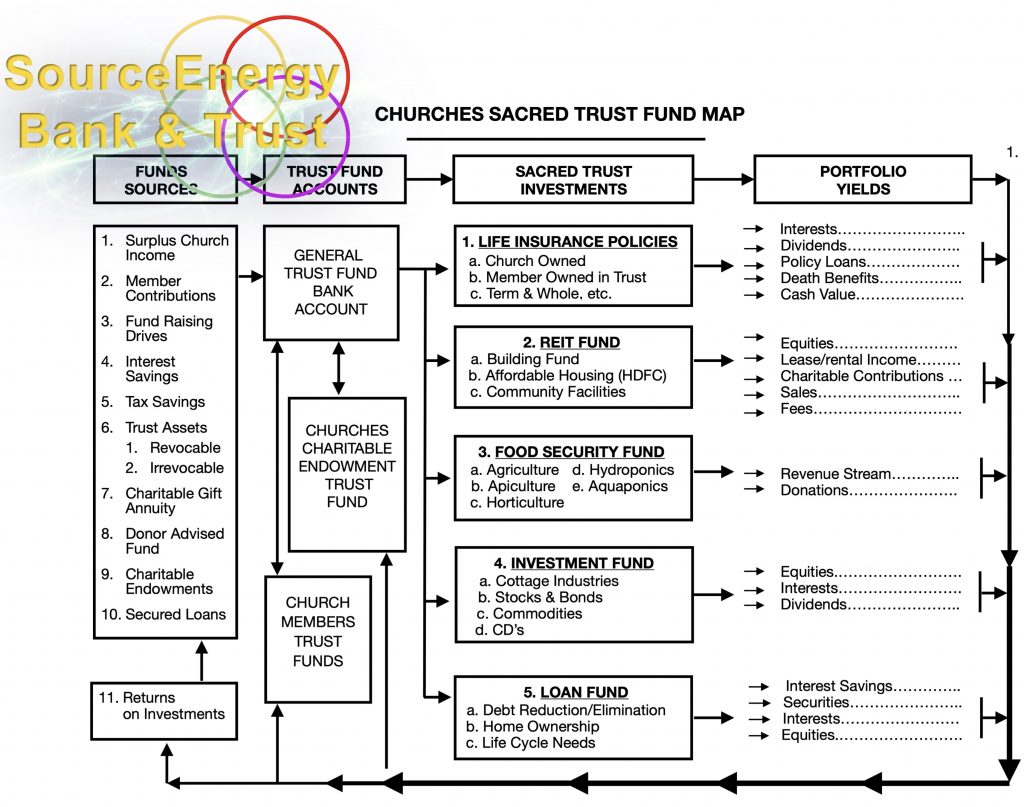

SourceEnergy Bank & Trust – Sacred Trust Fund Map

The SEG Sacred Trust Fund Map is an innovative financial management and investment framework, meticulously designed to cultivate and expand the fiscal resources of religious organizations while adhering to their sacred missions and values. This structured approach underpins the SourceEnergy Bank & Trust’s commitment to stewarding wealth through strategic, ethical, and impactful means.

Purpose of the SEG Sacred Trust Fund Map:

- Financial Stewardship: The Fund Map serves as a blueprint for religious entities to practice prudent financial stewardship, ensuring that surplus incomes, contributions, and other financial gains are managed with foresight and responsibility.

- Diversification of Income Streams: By identifying various sources of funds — from church incomes and member contributions to fundraising initiatives — the model promotes financial resilience and sustainability, essential for long-term growth and stability.

- Strategic Allocation: The division of funds into distinct trust fund accounts — such as the General Trust Fund Bank Account and the Church Charitable Endowment Trust Fund — allows for strategic allocation that aligns with both immediate operational needs and long-term charitable commitments.

- Investment in Community and Values: The Sacred Trust Investments detail various investment vehicles that not only yield financial returns but also reinforce the church’s commitment to its community. These include life insurance policies, real estate investments, food security initiatives, diversified investment funds, and loan funds that directly serve community needs.

- Ethical Returns: The portfolio yields section underscores the ethical dimension of the investments, focusing on generating returns from activities that align with the organization’s core values and community-centric missions.

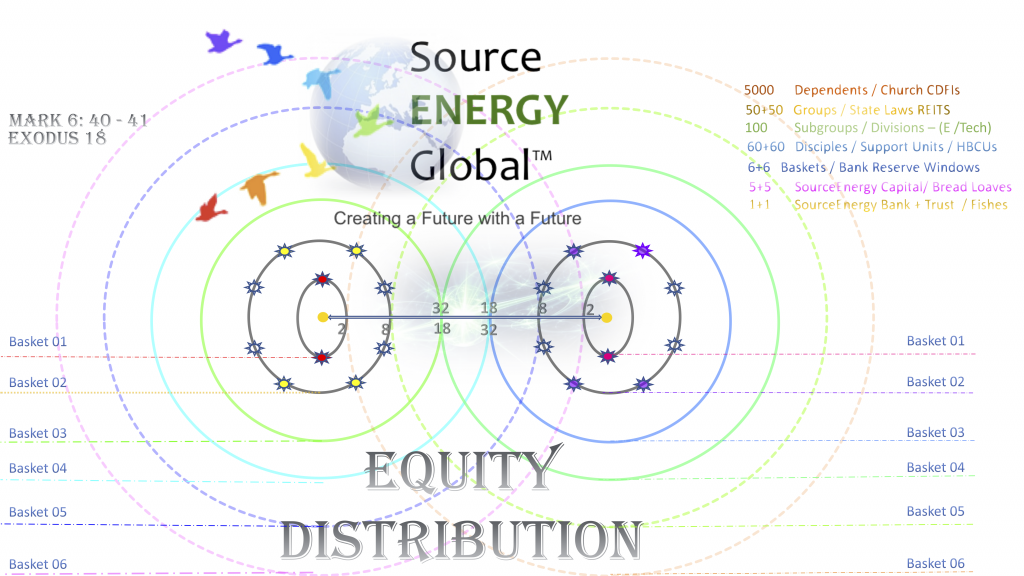

- Empowerment through Wealth Ecology: In line with the Wealth Ecology Model, the Sacred Trust Fund Map is not merely a financial tool but a holistic framework that embodies empowerment, community development, and the nurturing of ecosystems where wealth is dynamically generated and shared.

- Responsive to Change: The model is adaptive, designed to respond to the evolving needs of the community and shifts in the economic landscape, ensuring relevance and effectiveness in various scenarios.

In essence, the SEG Sacred Trust Fund Map is a testament to the SourceEnergy Bank & Trust’s vision of integrating sound financial practices with the mission of community support and empowerment. It is a strategic embodiment of the Wealth Ecology Model, reflecting a profound understanding of wealth as a means to foster, nourish, and sustain both the community and its deeply-held values.

Funds Source

1. Surplus Church Income

- Represents the financial surplus generated from church activities and services. This surplus is reinvested into the community and church initiatives, promoting sustainability and growth.

2. Member Contributions

- Voluntary donations from church members form a substantial part of the trust fund, reflecting the community’s commitment to the church’s mission and the collective investment in its future.

3. Fund Raising Drives

- Organized campaigns aimed at raising funds for specific projects or goals. These drives not only gather financial resources but also foster a sense of unity and purpose within the community.

4. Interest Savings

- Accumulated interest from savings and fixed deposits provides a steady income stream that supports the church’s financial base without necessitating further donations.

5. Tax Savings

- By leveraging tax-efficient strategies and structures, the church maximizes its financial resources, ensuring that more funds are available for its core activities and community work.

6. Trust Assets

- Comprising both revocable and irrevocable trusts, these assets provide a flexible and secure financial foundation for the church’s operations and missions.

7. Charitable Gift Annuity

- A form of donation where members contribute a substantial sum in exchange for a lifetime annuity, thereby supporting the church while receiving a stable income.

8. Donor Advised Fund

- A philanthropic vehicle that allows donors to make a charitable contribution, receive an immediate tax benefit, and then recommend grants from the fund over time.

9. Charitable Endowments

- Long-term investments where the principal amount is kept intact while the investment income is used for charitable efforts, ensuring perpetuity of support.

10. Secured Loans

- Loans that are backed by collateral, providing a low-risk financial tool for the church to leverage in case of large-scale projects or unforeseen expenditures.

11. Returns on Investments

- The overall returns generated from the various investment vehicles within the trust fund.

Trust Fund Accounts

1. General Trust Fund Bank Account

- A liquid account that serves as the operational backbone for the church, providing ready access to funds for daily activities and urgent needs.

2. Church Charitable Endowment Trust Fund

- A dedicated fund for the long-term charitable initiatives of the church, ensuring a lasting impact on the community and supporting the church’s spiritual mission.

Sacred Trust Investments

1. Life Insurance Policies

- A dual-purpose investment that provides financial security for church members while also serving as a potential source of liquidity for the church.

2. REIT Fund

- Investments in real estate, which can generate income from properties owned by the church, contributing to the church’s financial strength and its ability to serve the community.

3. Food Security Fund

- Investments in sustainable agriculture, apiculture, and horticulture initiatives that align with the church’s commitment to caring for creation and supporting local food systems.

4. Investment Fund

- A diversified portfolio of stocks, bonds, commodities, and certificates of deposit, offering a balanced mix of risk and return to support the church’s financial goals.

5. Loan Fund

- A fund dedicated to providing loans to church members for purposes like debt reduction, home ownership, and meeting life cycle needs, thereby directly supporting the financial wellbeing of the community.

Portfolio Yields

These yields represent the financial returns from the investments, including interests, dividends, and income from property leases or sales. These yields are crucial for the fund’s growth and its ability to continue supporting the church’s mission and the community’s wellbeing.

Each of these aspects reflects the Wealth Ecology Model’s principles, ensuring that the financial management and growth of the church’s resources are conducted ethically, sustainably, and in harmony with the community’s values and needs. The SEG Sacred Trust Fund Map, through this detailed structure, offers a blueprint for financial prosperity that aligns with the spiritual prosperity of the community it serves.

To illustrate the impact of the SEG Sacred Trust Fund, here are stories that showcase how community members and churches could benefit from the fund, in line with the Wealth Ecology Model:

Story 1: Building Foundations with the REIT Fund “Martha’s Garden” is a community initiative that was brought to life through the REIT Fund’s investment in affordable housing. The church, with support from the fund, developed a housing complex that not only provides affordable homes to families but also includes communal gardens where residents can grow their own food. Martha, a single mother who moved into the complex, shares, “This isn’t just a roof over our heads—it’s a community. My children have a safe place to play, and we’re learning to grow vegetables. It’s a fresh start for us.”

Story 2: Nurturing Growth with the Food Security Fund Pastor John, leading a small rural congregation, witnessed transformation when the Food Security Fund invested in their local agriculture project. “Our small town was struggling with food access,” he explains, “but the fund helped us set up a community-supported agriculture program. Now, every family has fresh produce, our youth are engaged in farming, and we’re self-sufficient. It’s a blessing that extends beyond our church doors.”

Story 3: Investing in Futures with the Loan Fund The Loan Fund was a beacon of hope for Alex, a young entrepreneur with a vision to start a computer repair shop in his community. Traditional banks were hesitant, but the Loan Fund saw potential in his plan and his passion for technology education. Alex shares, “Thanks to the Loan Fund, not only do I have a thriving business, but I also run workshops teaching computer skills to kids in the neighborhood. It’s about giving back and moving forward together.”

Story 4: A Lifeline with Life Insurance Policies When the unexpected happened, and the Thompson family lost their father, a life insurance policy arranged through the church’s Sacred Trust Fund provided much-needed financial stability. “The policy was something we had put in place through the church, never really thinking we’d need it so soon,” Mrs. Thompson recounts. “It has been a lifeline for us, helping to cover expenses and ensuring that our kids’ education can continue.”

Story 5: Education and Empowerment with Charitable Endowments The Charitable Endowments of the Sacred Trust Fund have enabled the local church to offer scholarships to promising students in the community. James, a scholarship recipient who is now studying environmental science, says, “The church believed in me when I didn’t have the means to pursue college. Now, I’m working on ways to help our community become more energy efficient. This scholarship didn’t just change my life; it’s changing our collective future.”

These stories demonstrate the tangible benefits that the SEG Sacred Trust Fund can offer, providing not only financial support but also fostering empowerment, education, and community development. They are reflective of the principles within the Wealth Ecology Model, showcasing how integrated financial strategies can lead to enriched community ecosystems.