SourceEnergy Africa

Economic Development Track Overview

Under the guidance of Dr. Oliver Jones, participants in the Economic Development track of Hampton University’s Young Diplomats Summer Program will delve into the intricacies of economic policies and development strategies that drive growth and sustainability across African countries. This track is designed to equip students with a thorough understanding of the economic landscape of Africa, emphasizing the critical roles of entrepreneurship and investment.

Key Components of the Economic Development Track

1. Entrepreneurship and Investment in Africa

- Introduction to Entrepreneurship: Participants will explore the fundamentals of entrepreneurship, including the qualities of successful entrepreneurs, the importance of innovation, and the role of small and medium-sized enterprises (SMEs) in economic development.

- Investment Opportunities: This section will cover various investment opportunities in Africa, including sectors such as technology, agriculture, renewable energy, and infrastructure. Students will learn about the factors that attract foreign direct investment (FDI) and the impact of FDI on local economies.

- Challenges and Solutions: The program will address common challenges faced by entrepreneurs and investors in Africa, such as access to capital, regulatory barriers, and market volatility. Strategies for overcoming these challenges, including microfinancing, venture capital, and government incentives, will be discussed.

- Case Studies: Real-world case studies of successful African entrepreneurs and businesses will provide practical insights into the entrepreneurial ecosystem and investment climate in different countries.

2. Development Strategies that Drive Growth in Each Country

- Economic Policies: An examination of various economic policies implemented across African countries, focusing on fiscal policies, monetary policies, and trade policies that promote economic stability and growth.

- Sustainable Development: Participants will learn about sustainable development practices, including the implementation of the United Nations Sustainable Development Goals (SDGs) in African contexts. The focus will be on strategies that balance economic growth with environmental sustainability and social equity.

- Infrastructure Development: The importance of infrastructure development, such as transportation networks, energy systems, and digital infrastructure, will be highlighted as key drivers of economic growth. Students will explore how infrastructure projects are financed and their impact on regional development.

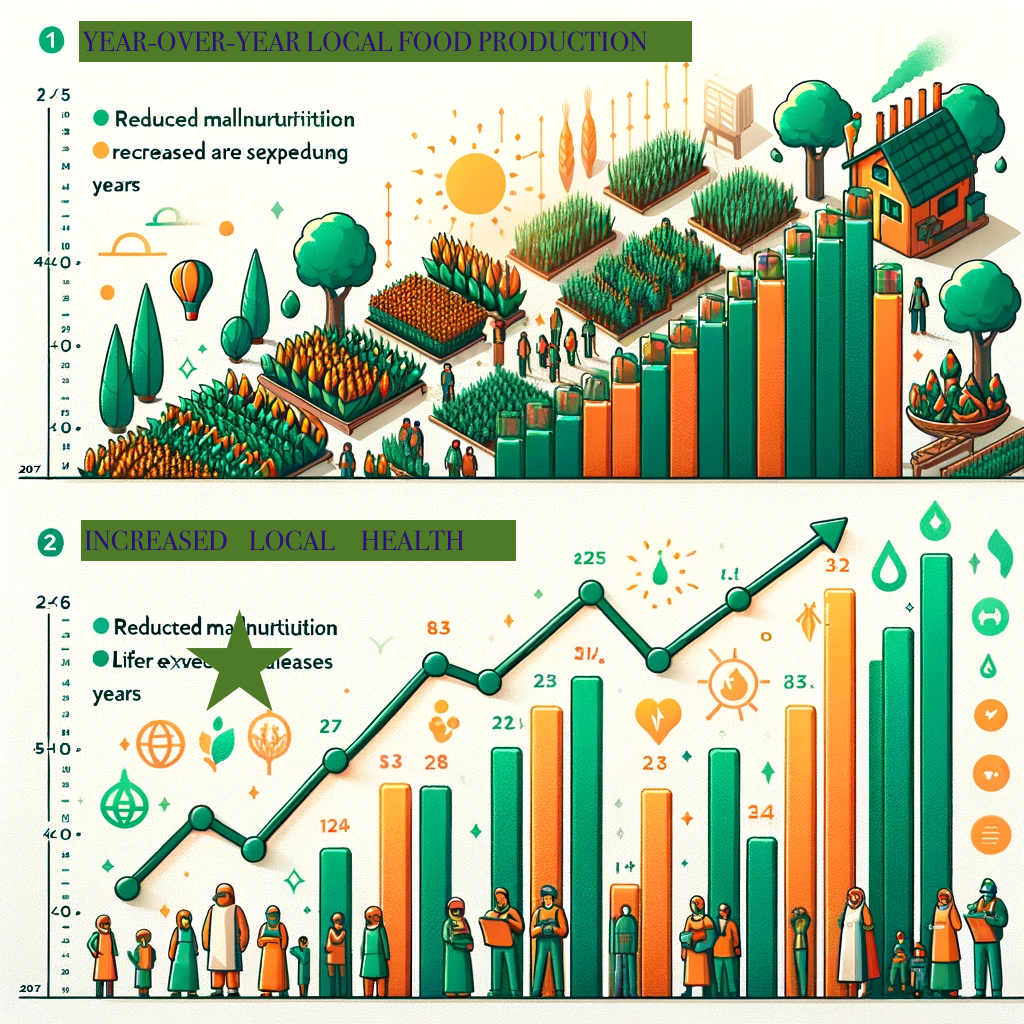

- Agricultural Development: Given the significance of agriculture in many African economies, this section will cover agricultural policies, modernization techniques, and innovations that enhance productivity and food security.

- Industrialization and Urbanization: Participants will study the processes of industrialization and urbanization, analyzing how these contribute to economic diversification and job creation. The role of special economic zones (SEZs) and industrial parks will be explored.

- Regional Integration: The program will also examine the benefits and challenges of regional integration initiatives, such as the African Continental Free Trade Area (AfCFTA), which aims to create a single market for goods and services across Africa.

Experiential Learning and Practical Application

To complement the theoretical knowledge, the Economic Development track will incorporate experiential learning activities, such as:

- Guest Lectures: Renowned economists, entrepreneurs, and policymakers will share their insights and experiences, providing students with real-world perspectives on economic development in Africa.

- Workshops and Simulations: Interactive workshops and simulation exercises will enable participants to apply their knowledge to practical scenarios, such as creating business plans, conducting market research, and developing investment proposals.

- Field Trips: Visits to local businesses, financial institutions, and development projects will offer students firsthand exposure to the economic environment and development initiatives in the region.

Conclusion

The Economic Development track, led by Dr. Oliver Jones, promises to be a transformative experience for participants in Hampton University’s Young Diplomats Summer Program. By exploring entrepreneurship, investment, and development strategies, students will gain a comprehensive understanding of the factors driving economic growth and sustainability in Africa. This knowledge will empower them to contribute meaningfully to global economic development and foster a new generation of leaders equipped to tackle the challenges and opportunities of the future.

Introduction to Entrepreneurship

In the Economic Development track of Hampton University’s Young Diplomats Summer Program, participants will embark on a comprehensive exploration of entrepreneurship. This segment is designed to provide students with a solid foundation in entrepreneurial concepts, highlighting the qualities of successful entrepreneurs, the pivotal role of innovation, and the significance of small and medium-sized enterprises (SMEs) in driving economic development.

Qualities of Successful Entrepreneurs

Understanding the essential traits that characterize successful entrepreneurs is crucial for budding business leaders. Participants will delve into the following key qualities:

- Vision and Passion: Successful entrepreneurs possess a clear vision for their business and a passionate drive to achieve their goals. They are able to articulate their vision and inspire others to join them on their journey.

- Resilience and Perseverance: The entrepreneurial path is fraught with challenges and setbacks. Resilient entrepreneurs demonstrate the ability to persevere through difficulties and adapt to changing circumstances.

- Risk-Taking and Decision-Making: Entrepreneurs often need to take calculated risks to seize opportunities and drive growth. Effective decision-making skills enable them to evaluate risks and make informed choices.

- Leadership and Team Building: Leading a successful venture requires strong leadership skills and the ability to build and motivate a cohesive team. Entrepreneurs must communicate effectively, delegate tasks, and foster a collaborative work environment.

- Creativity and Innovation: Creativity allows entrepreneurs to think outside the box and develop innovative solutions to problems. Innovation is the engine that drives progress and differentiates successful businesses from their competitors.

The Importance of Innovation

Innovation is a cornerstone of entrepreneurship and a key driver of economic development. Participants will explore how innovation:

- Sparks New Business Ideas: Innovative thinking leads to the creation of new products, services, and business models. This not only opens up new markets but also addresses unmet needs in existing ones.

- Enhances Competitiveness: Businesses that embrace innovation are better positioned to compete in the global marketplace. Continuous improvement and adaptation to changing trends ensure long-term success.

- Fosters Economic Growth: Innovative enterprises contribute to economic growth by creating jobs, increasing productivity, and generating wealth. They also stimulate further innovation through competition and collaboration.

- Solves Social and Environmental Challenges: Innovation is not limited to profit-driven ventures; it also plays a crucial role in addressing social and environmental issues. Social enterprises and sustainable business practices demonstrate how innovation can create positive change.

The Role of Small and Medium-Sized Enterprises (SMEs) in Economic Development

SMEs are vital to the economic health of any nation, particularly in developing regions. Participants will learn about:

- Job Creation: SMEs are significant contributors to employment, providing jobs to a large segment of the population. They offer opportunities for diverse skill sets and foster economic inclusivity.

- Economic Diversification: By operating in various sectors, SMEs contribute to the diversification of the economy, reducing dependence on a single industry and enhancing economic resilience.

- Local Development: SMEs often operate within local communities, driving development at the grassroots level. They help build local supply chains, stimulate demand for goods and services, and support regional economies.

- Innovation and Flexibility: SMEs tend to be more agile and innovative than larger corporations. Their ability to quickly adapt to market changes and implement new ideas makes them crucial players in dynamic economic landscapes.

- Entrepreneurial Ecosystem: SMEs form the backbone of the entrepreneurial ecosystem, providing a fertile ground for new ventures to emerge and grow. They also serve as training grounds for future entrepreneurs.

Conclusion

The “Introduction to Entrepreneurship” component of the Economic Development track will equip participants with a thorough understanding of the foundational elements of entrepreneurship. By exploring the qualities of successful entrepreneurs, the importance of innovation, and the role of SMEs in economic development, students will gain valuable insights that inspire and prepare them to become the next generation of entrepreneurial leaders. This knowledge will not only empower them to start their own ventures but also to contribute meaningfully to the economic and social development of their communities and beyond.

Investment Opportunities in Africa

As part of the Economic Development track in Hampton University’s Young Diplomats Summer Program, participants will explore a variety of investment opportunities in Africa. This section will provide a detailed overview of key sectors ripe for investment, the factors that attract foreign direct investment (FDI), and the significant impact FDI has on local economies.

Key Investment Sectors

- Technology

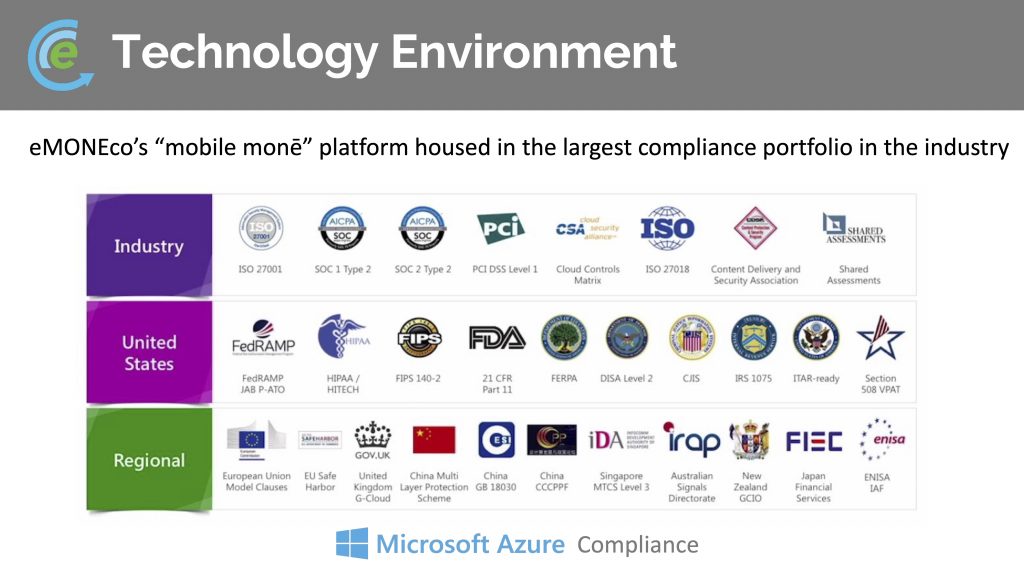

- Growth Potential: Africa’s technology sector is rapidly expanding, driven by increasing internet penetration, mobile phone usage, and a burgeoning young population. The continent is witnessing a tech boom, with numerous startups emerging in fintech, health tech, edtech, and e-commerce.

- Innovation Hubs: Major cities like Lagos, Nairobi, and Cape Town are becoming innovation hubs, attracting investment in tech incubators and accelerators that support startup growth.

- Digital Transformation: Investments in digital infrastructure, such as broadband networks and data centers, are critical to supporting the continent’s digital transformation.

- Agriculture

- Sector Importance: Agriculture is a cornerstone of many African economies, employing a significant portion of the population and contributing to food security.

- Modernization Opportunities: There is substantial potential for investment in modernizing agricultural practices, introducing advanced technologies like precision farming, and improving supply chains.

- Agri-business: Investments in agri-businesses, including food processing, storage, and distribution, can enhance value addition and reduce post-harvest losses.

- Renewable Energy

- Energy Demand: With a growing population and increasing energy demand, Africa’s energy sector offers vast investment opportunities, particularly in renewable energy.

- Sustainable Development: Investments in solar, wind, hydro, and geothermal energy projects support sustainable development goals by providing clean and affordable energy.

- Off-Grid Solutions: Off-grid renewable energy solutions, such as solar home systems and mini-grids, present significant opportunities to reach underserved rural communities.

- Infrastructure

- Infrastructure Deficit: Addressing Africa’s infrastructure deficit is crucial for economic development. Investments in transportation (roads, railways, ports), water and sanitation, and housing are highly impactful.

- Public-Private Partnerships: Governments are increasingly leveraging public-private partnerships (PPPs) to finance and develop large-scale infrastructure projects.

- Urbanization: Rapid urbanization across the continent necessitates investments in urban infrastructure to support growing cities and improve living standards.

Factors Attracting Foreign Direct Investment (FDI)

- Economic Stability and Growth

- Macroeconomic Policies: Stable macroeconomic policies and sound fiscal management create a conducive environment for investment.

- Growth Prospects: High growth rates and expanding consumer markets make African countries attractive destinations for FDI.

- Regulatory Environment

- Ease of Doing Business: Transparent and efficient regulatory frameworks, including streamlined business registration processes, reduce barriers to entry for investors.

- Legal Protections: Strong legal protections for investors, including property rights and contract enforcement, enhance investment security.

- Market Potential

- Consumer Base: Africa’s large and youthful population represents a growing consumer base with increasing purchasing power.

- Regional Integration: Regional trade agreements, such as the African Continental Free Trade Area (AfCFTA), create larger, integrated markets that attract investment.

- Natural Resources

- Resource Wealth: Africa’s abundant natural resources, including minerals, oil, and gas, offer significant investment opportunities, particularly in resource-rich countries.

- Sustainable Exploitation: Investments focused on sustainable resource extraction and value addition can drive economic growth while minimizing environmental impact.

- Government Incentives

- Tax Breaks and Incentives: Many African governments offer tax breaks, grants, and other incentives to attract foreign investors.

- Investment Promotion Agencies: Agencies dedicated to promoting investment provide valuable support and facilitation services to investors.

Impact of FDI on Local Economies

- Economic Growth

- Capital Inflows: FDI brings in much-needed capital, boosting economic growth and development.

- Job Creation: Investments create jobs, enhancing income levels and reducing unemployment.

- Technology Transfer

- Skills Development: FDI often involves the transfer of technology and skills, enhancing local workforce capabilities and productivity.

- Innovation: Foreign investment can spur innovation and the development of new industries.

- Infrastructure Development

- Project Financing: FDI helps finance critical infrastructure projects, improving connectivity and accessibility.

- Enhanced Services: Investments in infrastructure lead to better services and facilities for the local population.

- Market Access

- Export Growth: FDI can enhance export capacity by improving production efficiency and product quality.

- Global Integration: Local businesses gain access to global markets and networks, fostering international trade relationships.

Conclusion

The “Investment Opportunities” component of the Economic Development track provides participants with a comprehensive understanding of the various sectors in Africa that are primed for investment, the factors that attract FDI, and the transformative impact of such investments on local economies. This knowledge will empower students to recognize and harness opportunities, driving sustainable growth and development in Africa and beyond.

Challenges and Solutions in African Entrepreneurship and Investment

In the Economic Development track of Hampton University’s Young Diplomats Summer Program, participants will delve into the common challenges faced by entrepreneurs and investors in Africa. This section will explore issues such as access to capital, regulatory barriers, and market volatility, while also presenting effective strategies for overcoming these challenges, including microfinancing, venture capital, and government incentives.

Common Challenges

- Access to Capital

- Limited Financial Resources: Many entrepreneurs in Africa struggle to secure the necessary funding to start or expand their businesses due to limited availability of financial resources.

- High Interest Rates: When loans are available, they often come with high interest rates, making borrowing expensive and risky.

- Collateral Requirements: Banks and financial institutions typically require substantial collateral, which many small businesses and startups lack.

- Regulatory Barriers

- Complex Regulations: Navigating the regulatory landscape can be challenging due to complex and sometimes opaque regulations.

- Bureaucracy: Lengthy and cumbersome administrative procedures can delay business registration and other essential processes.

- Inconsistent Policies: Frequent changes in policies and regulations can create an uncertain business environment, deterring investment.

- Market Volatility

- Economic Instability: Fluctuations in economic conditions, such as inflation, currency devaluation, and political instability, can impact business operations and investment returns.

- Consumer Demand Variability: Changes in consumer demand due to economic cycles or external shocks can affect the stability and profitability of businesses.

- Supply Chain Disruptions: Inconsistent supply chains and logistical challenges can hinder business efficiency and growth.

Strategies for Overcoming Challenges

- Microfinancing

- Small Loans: Microfinance institutions provide small loans to entrepreneurs who do not have access to traditional banking services. These loans are often used to start or expand small businesses.

- Group Lending: Group lending models, where small groups of entrepreneurs receive loans collectively and support each other in repayment, can reduce default rates and build community trust.

- Financial Education: Microfinance programs often include financial literacy training, helping entrepreneurs manage their finances effectively and sustainably.

- Venture Capital

- Equity Financing: Venture capital (VC) provides equity financing to startups and high-growth potential businesses, offering an alternative to traditional loans.

- Mentorship and Support: VC firms often provide not just capital but also mentorship, strategic guidance, and access to networks, which can be crucial for business success.

- Innovation Hubs: Establishing innovation hubs and incubators can attract venture capital by creating environments conducive to entrepreneurial growth and collaboration.

- Government Incentives

- Tax Breaks and Subsidies: Governments can offer tax breaks, subsidies, and grants to encourage entrepreneurship and attract investment. These incentives reduce the financial burden on startups and small businesses.

- Business Support Services: Providing business development services, such as training, mentorship, and technical assistance, can help entrepreneurs navigate regulatory landscapes and enhance their operational capabilities.

- Investment Promotion Agencies: Dedicated agencies can facilitate foreign and domestic investment by providing information, reducing bureaucratic hurdles, and offering support throughout the investment process.

- Policy Reforms

- Simplifying Regulations: Streamlining and simplifying business regulations can make it easier for entrepreneurs to start and operate businesses. Clear and transparent regulatory frameworks build investor confidence.

- Stabilizing Policies: Consistent and stable economic policies reduce uncertainty and create a more predictable environment for business planning and investment.

- Public-Private Partnerships: Collaborative efforts between governments and the private sector can address infrastructure gaps, improve service delivery, and foster a conducive business environment.

- Risk Mitigation Strategies

- Diversification: Entrepreneurs and investors can mitigate market volatility by diversifying their investments across different sectors and regions.

- Hedging and Insurance: Financial instruments such as hedging and insurance can protect against currency risks, commodity price fluctuations, and other economic uncertainties.

- Resilient Supply Chains: Developing resilient and flexible supply chains can help businesses withstand disruptions and maintain operational continuity.

Conclusion

The “Challenges and Solutions” component of the Economic Development track provides participants with a nuanced understanding of the obstacles that entrepreneurs and investors face in Africa. By examining practical strategies such as microfinancing, venture capital, and government incentives, students will gain valuable insights into how these challenges can be effectively addressed. This knowledge will empower them to support and engage in entrepreneurial and investment activities that contribute to sustainable economic growth and development in Africa.

Central Africa

| Member State | Abbreviation |

|---|---|

| Republic of Burundi | Burundi |

| Republic of Cameroon | Cameroon |

| Central African Republic | Central African Republic |

| Republic of Chad | Chad |

| Republic of the Congo | Congo Republic |

| Democratic Republic of Congo | DR Congo |

| Republic of Equatorial Guinea | Equatorial Guinea |

| Gabonese Republic | Gabon |

| Democratic Republic of São Tomé and Príncipe | São Tomé and Príncipe |

Eastern Africa

| Union of the Comoros | Comoros |

| Republic of Djibouti | Djibouti |

| State of Eritrea | Eritrea |

| Federal Democratic Republic of Ethiopia | Ethiopia |

| Republic of Kenya | Kenya |

| Republic of Madagascar | Madagascar |

| Republic of Mauritius | Mauritius |

| Republic of Rwanda | Rwanda |

| Republic of Seychelles | Seychelles |

| Federal Republic of Somalia | Somalia |

| Republic of South Sudan | South Sudan |

| Republic of the Sudan | Sudan |

| United Republic of Tanzania | Tanzania |

| Republic of Uganda | Uganda |

Northern Africa

| People’s Democratic Republic of Algeria | Algeria |

| Arab Republic of Egypt | Egypt |

| Libya | Libya |

| Islamic Republic of Mauritania | Mauritania |

| Kingdom of Morocco | Morocco |

| Sahrawi Arab Democratic Republic | Sahrawi Republic |

| Republic of Tunisia | Tunisia |

Southern Africa

| Republic of Angola | Angola |

| Republic of Botswana | Botswana |

| Kingdom of Eswatini | Eswatini |

| Kingdom of Lesotho | Lesotho |

| Republic of Malawi | Malawi |

| Republic of Mozambique | Mozambique |

| Republic of Namibia | Namibia |

| Republic of South Africa | South Africa |

| Republic of Zambia | Zambia |

| Republic of Zimbabwe | Zimbabwe |

Western Africa

| Republic of Benin | Benin |

| Burkina Faso | Burkina Faso |

| Republic of Cabo Verde | Cabo Verde |

| Republic of Côte d’Ivoire | Côte d’Ivoire |

| Republic of the Gambia | Gambia |

| Republic of Ghana | Ghana |

| Republic of Guinea | Guinea |

| Republic of Guinea-Bissau | Guinea-Bissau |

| Republic of Liberia | Liberia |

| Republic of Mali | Mali |

| Republic of Niger | Niger |

| Federal Republic of Nigeria | Nigeria |

| Republic of Senegal | Senegal |

| Republic of Sierra Leone | Sierra Leone |

| Togolese Republic | Togo |