CDFI as Churches

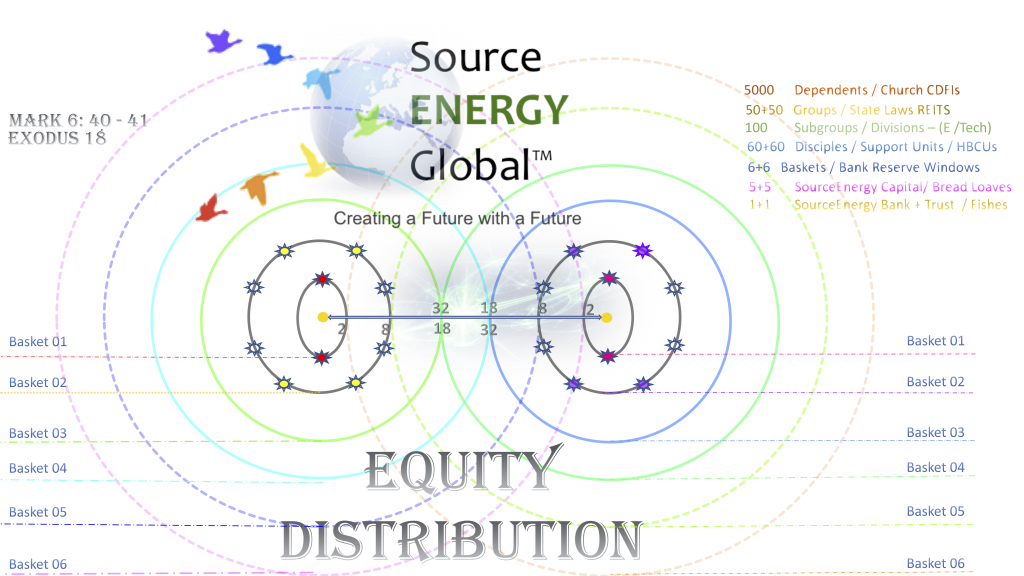

CDFIs (Community Development Financial Institutions) are financial intermediaries designed to promote economic opportunities for individuals, families, and small businesses in low-income communities. SourceEnergy Bank&Trust “Church of Churches” decentralized approach supports the Eco-System of local Church/CDFI Co-ops throughout the United States, Caribbean, and Africa. #5000

Why CDFIs?

1. CDFI banks reinvest up to 98% of loans and deposits into the local community, supporting underserved neighborhoods and business development. This allows for local economies to flourish, creating an ever-circulating pool of income for long-term financial stability.

2. Churches have the opportunity to support their local community and enable economic growth by working with CDFI banks. Banking with a CDFI creates a meaningful impact for those in need, and can even improve the church’s financial health.

3. By utilizing CDFI banks, churches can leverage their position in the local community in order to encourage residents and organizations to save and invest in their own neighborhoods. This multi-level participation has the potential to create a wave of economic development and capital across the community.

4. Working with CDFI banks creates more profitable and transparent banking partnerships than those associated with traditional banks. Through accountability and reporting requirements, CDFI banks must track and share their progress in tackling financial needs within the local area. This allows churches to keep track of the progress and obtain financing with confidence that funds are allocated appropriately.

5. Banking with a CDFI can generate funds used directly for a faith-based mission or many of its programs. In turn, this allows churches to leverage their resources and become active members of the economic development of their local community.

6. A key aspect of banking with a CDFI is that deposits and loans are reinvested multiple times in the same local community, which amplifies the impact of the church’s financial contribution. This cycle of circulation can improve the local economy within as little as seven to ten times, making a lasting impact within the local community.